Who said Bonds are Boring!

Share

In todays issue:

- Trading Quote

- Trading Strategy Tips

- Recommended Trading Books

- Whats on our Watchlist

- Trading Humour

Trading Quote

"If you personalize losses you can't trade" - Bruce Kovner

Bruce Covner was a famous trader who was featured in Jack Schwager's Market Wizard book series. Bruce mastered the art of controlling his emotions while trading and advised others to trade like machines and not let their emotions get the better of them.

In order not to personalize losses you need to ensure that your risk on each trade is small enough so a loss doesn't become emotional. You need to be able to take a loss and move onto the next trade.

Trading Strategy Quick Tips

- Avoid Overtrading Pitfalls - Overtrading can lead to losses. Maintain discipline by setting trading limits and avoiding impulsive actions in the heat of the moment.

- Set Realistic Trading Goals - Define achievable trading goals and track your progress. Goals provide direction and motivation for consistent improvement.

- Cultivating a Winning Mindset - A positive and patient mindset is crucial for trading success. Cultivate resilience, focus, and a winning mentality to thrive in the markets.

For more Trading strategy tips be sure to review our tutorial on Building a Systematic Trading Strategy.

Recommended Trading Books

New Market Wizards - Conversations with Americas Top Traders Jack Schwager continues his interviews with some of the world's top traders including Tom Basso and William Eckhardt. Although the traders interviewed trade different markets their success can be boiled down to the same essential formula: Solid Methodology + Consistent Execution = Trading Success

New Market Wizards - Conversations with Americas Top Traders Jack Schwager continues his interviews with some of the world's top traders including Tom Basso and William Eckhardt. Although the traders interviewed trade different markets their success can be boiled down to the same essential formula: Solid Methodology + Consistent Execution = Trading Success

What's on my Watchlist

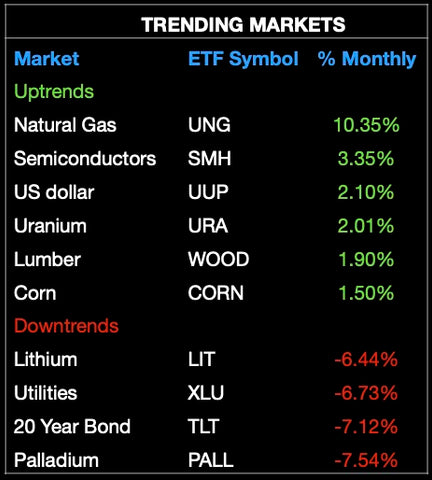

Your Trading Strategy should include a daily scan to find the strongest trending markets. Every day after the market closes as part of my trading strategy I scan my trading portfolio of approximately 50 markets to identify the ones that are showing strength and should be added to my watchlist. The strongest trending markets are highlighted in the table below. How does this compare to the markets on your watchlist?

The US Dollar and Uranium continue to show up in the Top Trending Markets week after week. One of the weakest markets over the past year has been the 20 Year Bond. A typical trend following trader would have entered a short trade on the 20 Year Bond in early 2022 and would still be in the trade today for a profit of almost 40%. Who said Bonds are boring!

Trading Humour